Ready to secure your home loan? Whether you’re looking to get pre-approved or you’re ready for the real deal, you’ll need to make one important decision: will you apply for your loan through a mortgage broker or a bank?

If you’re not sure where to start, this guide is for you. Keep reading and we’ll explore the differences between a mortgage broker and a banker, and how to make the right decision for you.

What is a Mortgage Broker, and How is it Different From a Bank?

First things first: what exactly are the differences between the two? A bank and a mortgage broker will both help you secure a home loan, but the behind-the-scenes details are where things differ.

Simply put, here are a few of the key differences:

- A broker works with many banks or other lending institutions and is able to shop around to find you the best rates and terms. Think of a broker as the middleman between you and the potential lenders and banks.

- A bank, of course, is a direct lender that represents one institution.

So, which is right for you? We’ll get into that next.

Mortgage Brokers vs. Banks: Advantages to Using a Mortgage Broker

Most would-be homeowners are on the hunt for the best loan rates. After all, you’ll be stuck with your mortgage for anywhere from 8-30 years, so you’ll want a monthly payment that you’re comfortable with! Here are some of the big advantages of using a mortgage broker.

Access to a Wide Variety of Lenders

Because brokers have access to many direct lenders, they can shop around and match you with the right one for your situation. They’re like your personal travel agent, selecting from the best airlines, hotels, and car rental companies to find you the best deal for your individual needs. They’ve got your back, and they’ll work with you to get it right.

Brokers Will Save You Time (and Stress!)

A broker will also save you time in the long-run. Since you’ll only need to submit one application in total, rather than one for every bank or lender on your own, this can be a huge relief. You’ve likely got enough on your plate right now, anyway! Once you’ve submitted one application to your broker, they’ll run through your options with you, including rates, points (if applicable), and closing costs. Simply put, they make the comparison easier.

Brokers Can Save You Money

While there are no guarantees that a broker can find a cheaper rate than a direct lender, let’s be real: most consumers don’t have the time (or the right means) to go out and rather all of the lenders and rates available to them. Approaching your bank can be time consuming, and even then you only have one comparison point to consider. In most cases, it will end up being much more cost-effective to work with a broker instead of taking your chances and going direct.

Also, keep in mind that brokers have access to loans at a wholesale rate from lenders, which often means a lower cost to begin with—so any cost increase attributed to your broker’s fee usually ends up a wash.

Brokers Are There to Help

Overall, your broker will be there to represent you and your interests, rather than those of a bank—where you might just be a number (or a commission) for them. As such, you should expect to provide a lot of information upfront to your broker about your needs and your individual situation. Have questions along the way? Your broker is there to help you find answers and offer knowledgeable advice that’s in your best interest. Have a complicated situation? An experienced mortgage broker will know how to find innovative solutions.

Moreover, your broker can help steer you away from lenders that should be avoided. If you see a rate that seems too good to be true, you’ll often find sketchy payment terms buried deep in the contract. And over the life of a loan, this can be a very expensive mistake. As a new homeowner especially, you’re likely learning a lot about mortgages and all of the vocabulary that goes along with it— it can be a lot! Your broker is there to help you fully understand the offers on the table.

Mortgage Brokers vs. Banks: A Few Things to Know

Of course, there may be some situations where working with a mortgage broker isn’t the right fit for you. Here are a few things to keep in mind.

Brokers Typically Charge a Fee

In exchange for their services and connections, brokers will typically charge a fee. Sometimes the fee is paid for by the lender, and sometimes it’s added into your closing costs—so you’ll definitely want to research this and understand the terms before you sign anything.

Brokers Don’t Always Have the Best Deals

Like we mentioned earlier, there’s no guarantee that your broker can get the best deal. If you have an established relationship with a bank (i.e. if you’ve been a member for many years with current accounts, or you have other types of loans with them), they may quote you better rates or be more willing to work with you to secure a great deal. Loan officers at these kinds of institutions also have a bit more flexibility. They may be able to offer you special deals, make exceptions to standard policies, or even waive certain fees. Again, you’ll want to factor this in as you make your decision and compare your options.

How Mortgage Goat Can Help You

So, is it better to get a mortgage from a bank or broker? We hope the information above has helped you understand your options.

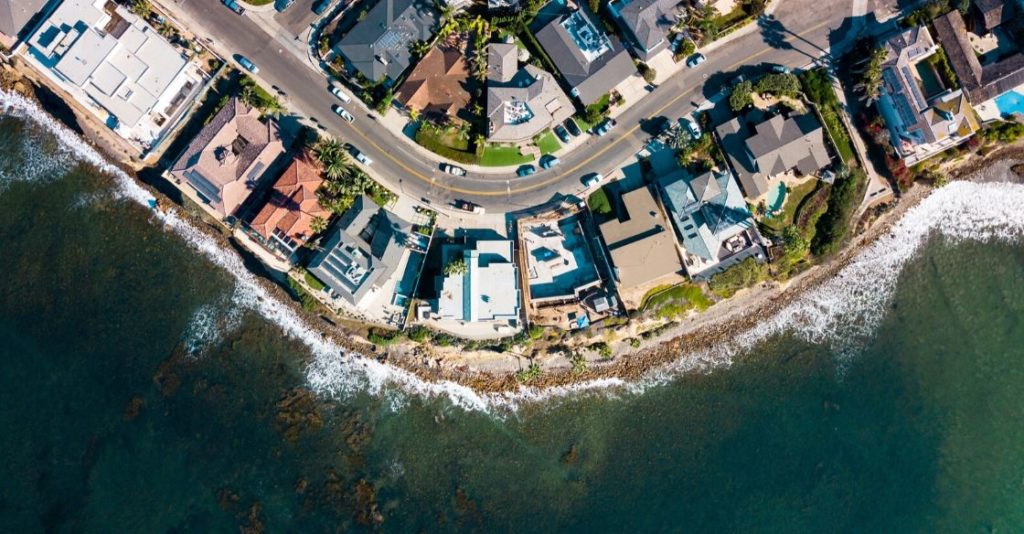

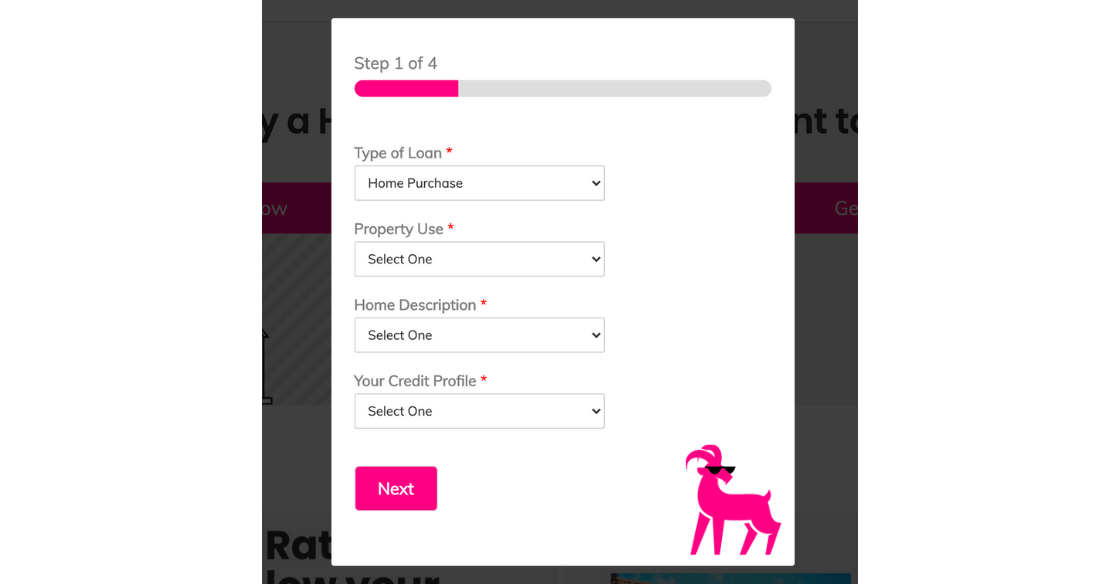

Ready to explore what a mortgage broker can do for you? At Mortgage Goat, we’re your friendly mortgage broker in San Diego, here to help you every step of the way. We work with over 100 lenders to secure you the best rate out there. All you have to do is take a few minutes to fill out our simple, 100% online application. Contact us and get started today!