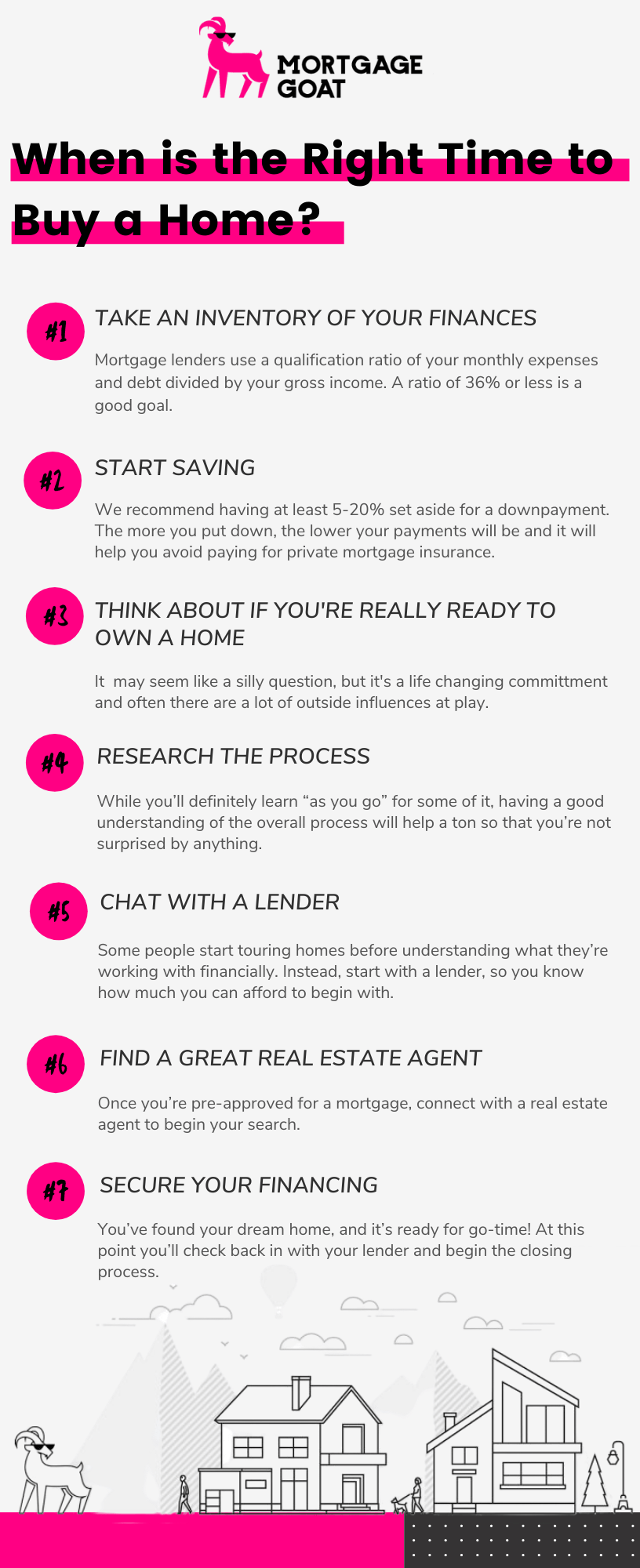

Dreaming of your first home, but not sure if it’s the right time to pull the trigger? It’s a big decision, so you’re certainly not alone. Buying your first home — and everything that goes along with it — can be time-consuming and confusing, from house hunting to getting your mortgage (and finding the best mortgage rates to begin with) and everything in between.

But buying a home is also incredibly rewarding. So why put your dreams on hold? To help you feel more confident, we’ve put together a handy checklist so you can determine if it’s the right time for you. Buckle up, keep reading, and find out for yourself!

Does Everything Add Up, Financially?

First up, some real talk: if your income isn’t quite where it needs to be (and/or you’ve got a lot of debt on your shoulders), it’s probably not the best time to buy a house. Obviously you need to make enough to cover a monthly mortgage, utilities, and any repairs or maintenance that the home might require. But your finances will also affect the loan you’re approved for.

To determine your eligibility, mortgage lenders use what’s called a “qualification ratio,” which is your monthly expenses and debt divided by your monthly gross income (your income before taxes are taken out). Lenders can set their own guidelines here, but a ratio of 36% or less is a good goal. It’s smart to take it a step further on your own, too — most financial planners recommend that your total housing expenses don’t exceed 32% of your gross monthly income. So while you might be approved for a certain amount, make sure to run ALL the numbers on your own, as well.

Not looking so hot? If your debt is high, the smart move is to pay most or all of it off before even thinking about buying a home. This includes student loans, credit card bills, and car loans. While you’re at it, check your credit score; it can take some time for your score to improve as you pay off your loans.

If your monthly expenses look out of control, think about some ways you can shrink them. For example, can you cut back on takeout and cook more at home? Do you really need six different streaming services? While you don’t want to ever stretch beyond your means, these small changes can add up over time as you wait for the right time to buy.

Do You Have Enough in Savings?

Fun fact about purchasing a home: there are usually a LOT of “hidden” expenses. This goes for the actual buying process (down payment, closing costs, home appraisals, etc.) but also… for the rest of your life as a homeowner! You no longer have a landlord to call out for repairs — anything that breaks, leaks, or otherwise causes problems is now your expense to deal with.

For your down payment, most experts recommend setting aside 20% of the home’s purchase price. Depending on your lender, you may be able to get away with less. But the more you put down, the more equity in the home you start out with, which means less in interest and fees over the course of the loan. You’ll also cut down your monthly payment a bit, which leaves you more wiggle room for all those emergencies that might come up!

A 20% down payment will help you avoid paying for private mortgage insurance (PMI).

Do You Really Want to Own a Home?

Now that you’ve got the financial elements sorted out, make sure you’ve spent some thinking about whether you truly want to own a home. It may seem like a silly question, but often there are a lot of outside influences at play. Maybe you’re seeing all of your friends buy their first homes and you don’t want to feel left behind. Or perhaps the idea of homeownership outweighs the reality.

But, of course, there are a lot of perks to owning a home. You’ll have total control of the space, without having to get approval from anyone else (unless you have an HOA). You’ll also likely have a more long-term vision, so you can truly “plant your roots” and feel at home. And of course, you’re building equity along the way. If all of that sounds worth it to you, you’re on the right track!

Do You Know Where to Start?

Finally, are you familiar with the home-buying process? While you’ll definitely learn “as you go” for some of it, having a good understanding of the overall process will help a ton so that you’re not surprised by anything. Do you know how to get a mortgage? Do you know how much a home inspection costs, and why you should get one?

Most first time home buyers follow these steps:

Chat with a Lender First, Before Doing Anything Else

Some people start touring homes before understanding what they’re working with financially. Instead, we recommend starting with a lender. That way, you know the best mortgage rates you can take advantage of and how much you can afford to begin with. Don’t worry too much about getting a mortgage, either: online lenders like Mortgage Goat make the process super simple and fast.

For reference, some of the things you need to get a home loan are pay stubs, bank statements, and tax returns from the last several years.

Find a Great Real Estate Agent to Work With

Once you’re pre-approved for a mortgage, connect with a real estate agent to begin your search. Not sure where to start? Try asking friends, family members, or coworkers for referrals, particularly someone with experience in the neighborhoods you’d like to focus on. Market trends can vary widely, so local knowledge and expertise are key. They should also be part of the National Association of Realtors (NAR) and have some certifications under their belt.

Secure Your Financing

You’ve found your dream home, and it’s ready for go-time! At this point you’ll check back in with your lender and begin the closing process. Assuming everything goes smoothly, congrats! It’s time to celebrate. See? Buying a home is easy once you know what to expect.

Let Mortgage Goat Help You Get Started

If you’ve decided it’s the right time to buy your first home, we’re here to help! With Mortgage Goat, you’ll get instant loan estimates and the best mortgage rates available, all in three easy steps. Plus, it’s 100% online — no trekking to an office or filling out stacks of physical paperwork. Get started today and you’ll see what we mean!