Rapidly changing technology has left few industries untouched, and the mortgage industry is no exception. Historically, mortgages have been processed through large, big-name banks. Thanks to alternative, non-bank lending companies, prospective homeowners now have more lending options and can complete the mortgage process almost entirely online—saving time, money, and hassle.

Following the 2008 housing crisis, the big banks that once dominated the mortgage market suddenly faced increased regulations, stringent fines, and expensive lawsuits. As a result, the largest US banks—including Bank of America, JPMorgan Chase, and Wells Fargo—started to decrease mortgage lending and increase credit score requirements. This left a growing population of prospective homeowners without options until a number of new companies emerged to fill the gap. These alternative lenders, like Mortgage Goat, have taken advantage of the technological revolution to ultimately give clients more options and greater rate transparency. Below are a few of the ways these new “middlemen” lending sites are revolutionizing the mortgage market.

Mortgage marketplaces allow homebuyers to choose a lender

Alternative mortgage marketplace companies have taken an entirely new approach to the lending process. Rather than acting as the direct lender (like a traditional bank would), these mortgage websites act as “middlemen” that connect loan originators to clients. This means that they offer prospective buyers a number of lenders from which they can choose. Clients then have the flexibility to select a lender with a mortgage rate that best suits their needs and finances.

What does that look like in practice? A client visits the mortgage marketplace website and submits a basic application for a mortgage, then a mortgage rate algorithm matches the client with a list of potential lenders. After the client chooses between the lenders, the middleman company receives a small payment for connecting the client with the lender. The client then works directly with the lender to complete the home loan process.

Some lenders like MortgageGoat have taken another step by offering one-on-one consultations with experienced professionals to help guide prospective homeowners in their decision-making. This makes the process more personal and helps ensure that the clients will feel supported throughout the process.

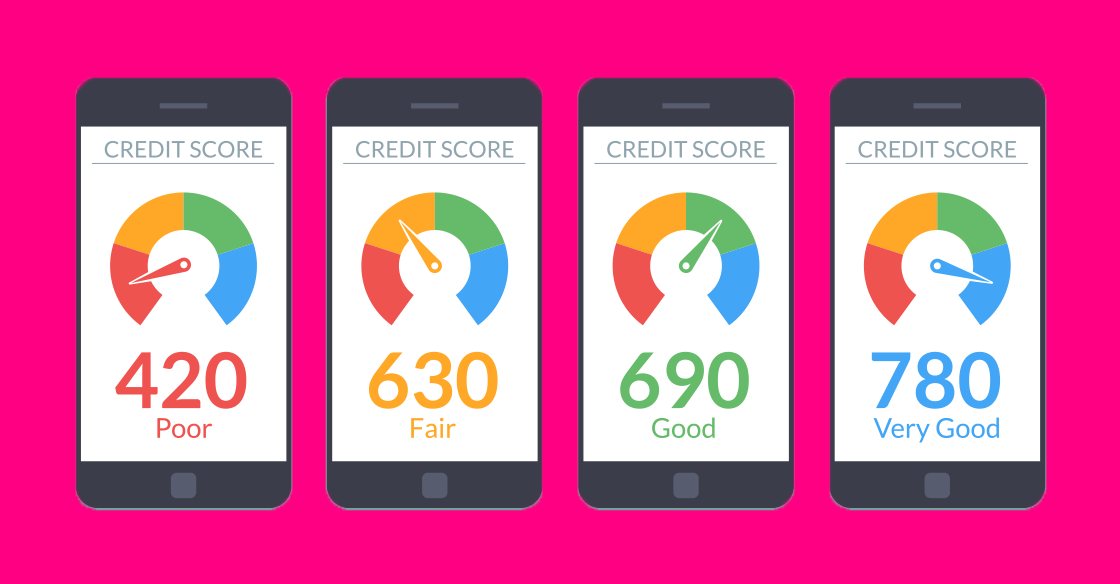

Mortgage marketplaces offer more options for clients with lower credit scores

One of the unfortunate outcomes of the housing crisis is that the larger, reliable banks that dominated the market suddenly became reluctant to dole out loans to clients with lower credit scores. Federal Housing Administration (FHA) loans had historically been the go-to loan option for first-time homeowners or those with less-than-perfect credit, and many banks simply stopped offering them. This was a sudden and debilitating barrier for many prospective buyers.

In response, mortgage marketplaces have partnered with smaller, local, family-run or community mortgage lenders. While there is less perceived “security” in working with these lenders, it turns out that there are huge advantages. These smaller firms are not regulated on a federal level like big banks, and therefore they are willing to accept prospective homebuyers who do not have soaring credit scores. In addition, they offer the government-backed FHA loans that bigger banks have stopped providing after the housing crisis.

Mortgage marketplaces speed up the home-buying process

One of the main advantages of working with a mortgage marketplace is that it simplifies and streamlines the mortgage process. The old-fashioned system of applying for a home loan involved piles of paperwork and administrative delays. Now, clients can simply enter their information online and receive real-time, immediate feedback about their options and rates due to the websites’ algorithms that systematically match buyers with the best lender options.

To address the general public’s widespread distrust about entering data online, Mortgage Goat and other websites use secure electronic communication technology to protect clients’ privacy.

More mortgage options for the future

Thanks to mortgage marketplaces like MortgageGoat, there are now more options than ever before for affordably financing a home. The advantages of using the middleman approach—Including quicker approvals, extensive lender options, online applications, and less paperwork—are helping these sites transform the mortgage industry. The Federal Reserve reported that alternative lenders are now taking on about 45% of all home loans, which is the largest share in the last 20 years. This reflects the reliability and trust these alternative lenders have gained in the wake of the housing crisis, which left so many prospective homeowners without options.

Mortgage marketplaces vary in terms of what is required to complete the process (some offer applications that can be completed entirely online, whereas others require the client to get forms notarized), so make sure to read the instructions on the site you will be working with. Most sites have clear, step-by-step directions on the site, and many offer private, one-on-one consultations to help you navigate any additional questions or concerns. It has never been easier to quickly and affordably complete the steps necessary to take out a home loan.

Connect digitally with our team of experienced mortgage brokers to start your home buying journey, today!